Multiple Choice

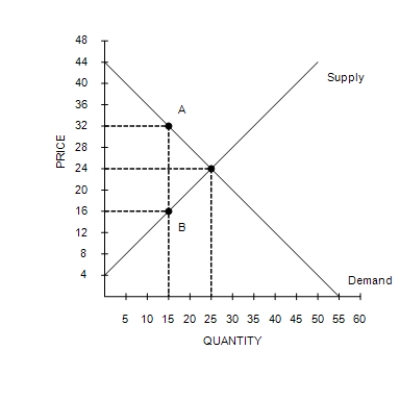

Figure 8-3

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-3. As a result of the tax, consumer surplus decreases by

A) $130, producer surplus decreases by $170, tax revenue is $240, and deadweight loss is $60.

B) $150, producer surplus decreases by $150, tax revenue is $240, and deadweight loss is $60.

C) $160, producer surplus decreases by $160, tax revenue is $240, and deadweight loss is $80.

D) $240, producer surplus decreases by $240, tax revenue is $400, and deadweight loss is $80.

Correct Answer:

Verified

Correct Answer:

Verified

Q83: When a tax is imposed on a

Q84: Figure 8-1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7555/.jpg" alt="Figure 8-1

Q85: Scenario 8-3<br><br>Suppose the market demand and market

Q86: Figure 8-10<br><br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7555/.jpg" alt="Figure 8-10

Q87: A tax on a good causes the

Q89: Figure 8-9<br><br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7555/.jpg" alt="Figure 8-9

Q90: When a tax is imposed on buyers,

Q91: Scenario 8-3<br><br>Suppose the market demand and market

Q92: Figure 8-10<br><br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7555/.jpg" alt="Figure 8-10

Q93: Figure 8-9<br><br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7555/.jpg" alt="Figure 8-9