Multiple Choice

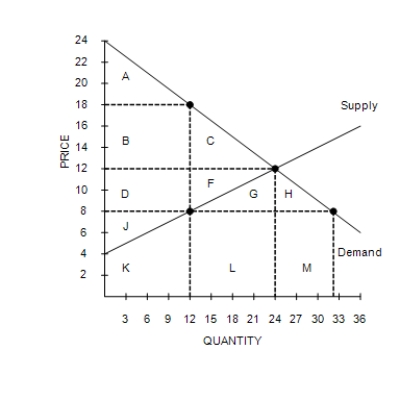

Figure 8-4

Suppose the government imposes a $10 per unit tax on a good.

-Refer to Figure 8-4. The tax causes consumer surplus to decrease by the area

A) A.

B) B + C.

C) A + B + C.

D) A + B + C + D + F.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q100: If a tax shifts the demand curve

Q101: Figure 8-10<br><br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7555/.jpg" alt="Figure 8-10

Q102: The greater the elasticity of demand, the

Q103: A tax raises the price received by

Q104: John has been in the habit of

Q106: Tax revenue equals the size of the

Q107: Figure 8-2<br>The vertical distance between points C

Q108: When a good is taxed, the tax

Q109: Concerning the labor market and taxes on

Q110: If the size of a tax doubles,