Essay

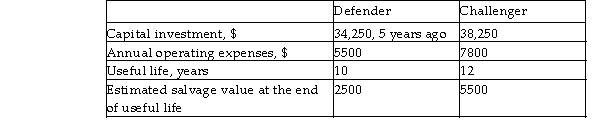

Razorback Corp. is evaluating whether it should keep its automatic guided vehicle or sell it immediately and purchase a new one. The current vehicle can be sold for $28,000 now; however, with an overhaul of $8250, the current vehicle can last another 5 years. Other relevant costs are shown below. Use a before- tax MARR of 5% per year and determine whether the current vehicle should be replaced.

Correct Answer:

Verified

EUACD 5%) = $13,421.25 EUACC 5...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: A bin activator has an initial cost

Q3: Yellowjacket, Inc., a large textile company, is

Q4: Bruin Manufacturing is evaluating whether it should

Q4: Aztec, a manufacturer of hard board and

Q5: A challenger asset with a maximum useful

Q6: Three years ago, a company purchased a

Q8: Lumberjack Power, operator of a nuclear power