Essay

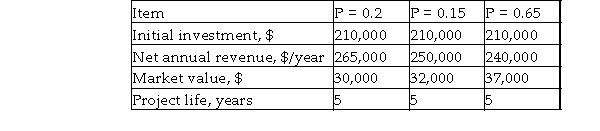

Kewpie, Inc. is considering purchasing a new set of packaging and labeling equipment. A comparison of estimated cash flows is shown below.  If straight- line depreciation with a salvage value of $32,000 and a useful life of 5 years is used, determine whether Kewpie should invest in the equipment on the basis of the expected value of after- tax PW. Assume an effective tax rate of 35% and a MARR of 10% per year.

If straight- line depreciation with a salvage value of $32,000 and a useful life of 5 years is used, determine whether Kewpie should invest in the equipment on the basis of the expected value of after- tax PW. Assume an effective tax rate of 35% and a MARR of 10% per year.

Correct Answer:

Verified

EPW10%)) = $465,633....View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: The estimated annual cash flow of an

Q2: Buffalo Manufacturing is considering purchasing new equipment

Q3: Amy wants to estimate the average number

Q4: An engineer is considering the size of

Q4: The probability distribution of a certain overhead

Q7: Gopher Manufacturing is considering purchasing new calibration