Short Answer

Use the following information for questions.

Nelly Inc. reported net credit sales of $24,000,000 and cost of goods sold of $18,000,000 for the year. The average inventory for the year was $6,000,000.

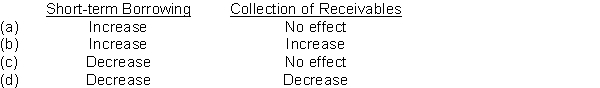

-If a company has a current ratio of 1.3:1, what effects will the borrowing of cash by short-term debt and collection of accounts receivable have on the ratio?

Correct Answer:

Verified

Correct Answer:

Verified

Q56: Selected data from McAllister Corp. are presented

Q57: On financial statements that include vertical analysis,

Q58: Explain and apply comparative analysis.

Q59: In horizontal analysis, the percentage of a

Q60: Presented below are liquidity and solvency ratios

Q61: Use the following information for questions.<br>Nelly Inc.

Q62: The following ratios have been calculated for

Q64: Horizontal analysis is also called<br>A) percentage analysis.<br>B)

Q65: Horizontal analysis of comparative financial statements includes

Q66: The current ratio is a<br>A) liquidity ratio.<br>B)