Multiple Choice

Use the following information to answer questions.

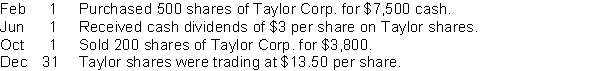

Wells Inc. reported these transactions relating to marketable Held for Trading Investments intended to generate net income and to be sold in the near term:

-The entry to record the sale of the shares on Oct 1 would include a

A) credit to Held for Trading Investments for $3,800.

B) credit to Realized Gain for $800.

C) credit to Unrealized Gain for $800.

D) debit to Unrealized Gain for $3,800.

Correct Answer:

Verified

Correct Answer:

Verified

Q42: Corporations purchase investments in debt or equity

Q67: Use the following information to answer questions.<br>Wells

Q68: Explain how investments are reported in the

Q73: Debt investments are all of the following

Q74: Under the equity method,<br>A) the receipt of

Q75: Corporations invest in other companies for all

Q76: On January 1, 2017, Marianne Corp. purchased

Q77: Use the following information for questions.<br>On January

Q93: Under both IFRS and ASPE, the investor

Q99: Only debt investments can be accounted for