Multiple Choice

Use the following information to answer questions.

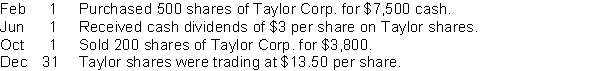

Wells Inc. reported these transactions relating to marketable Held for Trading Investments intended to generate net income and to be sold in the near term:

-The entry, if any is required, to record the value of the investment on December 31 would include a debit to

A) Realized Losses for $450.

B) Unrealized Loss for $750.

C) No entry is required.

D) Unrealized Losses of $450.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: When an investee can be significantly influenced,

Q50: During its first year of operation, Snapper

Q51: Held for Trading Investments are all of

Q52: Use the following information for questions.<br>On January

Q52: Strategic investments are debt or equity securities

Q53: On January 1, Kensington Corporation, as a

Q56: Aroma Limited owns a 25% interest in

Q59: Realized gains and losses are always reported

Q60: Interest revenue is calculated by multiplying the

Q117: Under both IFRS and ASPE, investors can