Multiple Choice

Use the following information for questions.

On January 1, 2017, Marianne Corp. purchased $50,000, of Robin Ltd.'s 4%, 10-year bonds for $48,000, since the market interest rate was approximately 4.5%. The bonds pay interest on January 1 and July 1. Marianne has a calendar year end, and classified the bonds as long-term investments. The fair value on December 31, 2017 was $48,500. Marianne sold the bonds on January 2, 2018 for $48,500.

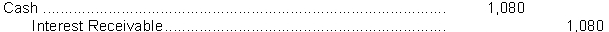

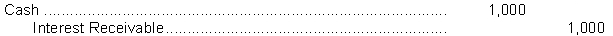

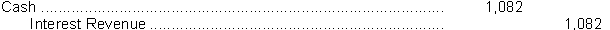

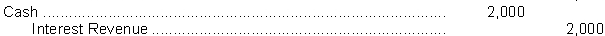

-The entry for the receipt of interest on January 1, 2018 is

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Use the following information for questions.<br>On January

Q14: Non-strategic investments that are held for the

Q15: Amortization of bond premiums for bond investments

Q16: Other comprehensive income (loss)<br>A) has no impact

Q18: Which one of the following statements is

Q19: Under the equity method of accounting for

Q20: Which of the following is false?<br>A) The

Q21: Ontario Corporation (a private corporation) reported the

Q22: If a company acquires a 40% interest

Q31: If there is a bond premium on