Multiple Choice

Use the following information for questions.

On January 1, 2018, Warner Inc. purchased 3.5%, $50,000 face value Jackson Corp. bonds at face value. Interest is payable semi-annually on July 1 and January 1. The bonds are classified as held for trading investments. The bonds were sold on July 2, 2018 for $53,000.

-On January 1, Saskatoon Corporation purchased as a trading investment a $1,000, 6% bond for $1,060. The bond pays interest on January 1 and July 1. After receiving and recording the interest, the bond is sold on July 1 for $1,100. What is the entry to record the cash proceeds at the time the bond is sold?

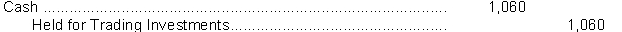

A)

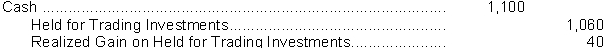

B)

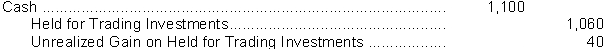

C)

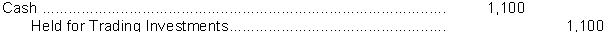

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q31: At acquisition, non-strategic investments are recorded at

Q32: Amortization of bond discounts for bond investments

Q33: When an investor owns more than 50%

Q34: Use the following information for questions.<br>On January

Q37: Use the following information for questions.<br>On January

Q38: The ability of an investor to affect

Q39: Which of the following statements is not

Q40: Use the following information for questions.<br>On January

Q41: If 30% of the common shares of

Q46: Premiums and discounts must be amortized on