Essay

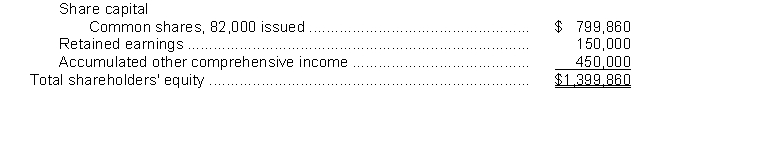

Glenn Corporation's shareholders' equity section at December 31, 2017 appears below:Shareholders' equity  On June 30, 2018, the board of directors declared a 15% stock dividend, distributable on July 31 to shareholders of record on July 15. The fair value of Glenn Corporation's shares on June 30 was $14.On December 1, 2018, the board of directors declared a 2-for-1 stock split effective December 15. Glenn Corporation's shares were selling for $20 on December 1, 2018, before the stock split was declared. Net income for 2018 was $230,000 and there were no cash dividends declared.Instructions

On June 30, 2018, the board of directors declared a 15% stock dividend, distributable on July 31 to shareholders of record on July 15. The fair value of Glenn Corporation's shares on June 30 was $14.On December 1, 2018, the board of directors declared a 2-for-1 stock split effective December 15. Glenn Corporation's shares were selling for $20 on December 1, 2018, before the stock split was declared. Net income for 2018 was $230,000 and there were no cash dividends declared.Instructions

a. Prepare the journal entries on the appropriate dates to record the stock dividend and the stock split. If no entry is needed write "No entry required."

b. Prepare all closing entries required on December 31, 2018.

c. Fill in the amounts that would appear in the shareholders' equity section for Glenn Corporation at December 31, 2018, for the following items:

Correct Answer:

Verified

Correct Answer:

Verified

Q34: Stock Dividends Distributable is reported as a

Q77: A company may reacquire its own shares

Q80: If a corporation declares a 10% stock

Q81: Use the following information for questions.<br>Fair Corporation

Q86: Which of the following would not be

Q87: Which of the following is not a

Q88: Corporations reporting under IFRS have the option

Q130: Companies reporting under ASPE must disclose basic

Q140: The sale of shares in a corporation

Q207: A corporation is not an entity that