Essay

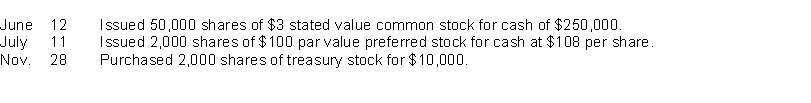

Miles Co. had these transactions during the current period.  Instructions

Instructions

Prepare the journal entries for the preceding transactions.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: On January 1, Hamblin Corporation had 90,000

Q35: Herman Corporation had net income of $120,000

Q38: A stock split results in a transfer

Q115: Which of the following statements is <b>not</b>

Q119: Which of the following is not a

Q131: Logan Corporation issues 40,000 shares of $50

Q138: On January 1, 2014, Mather Corporation had

Q154: Retained earnings are occasionally restricted<br>A) to set

Q167: A corporation records a dividend-related liability<br>A)on the

Q202: Looper, Inc. has 30,000 shares of 6%,