Short Answer

During 2014 Kenton Corporation had the following transactions and events:

1. Issued par value preferred stock for cash at par value

2. Issued par value common stock for cash at an amount greater than par value

3. Completed a 2 for 1 stock split in which the $10 par value common stock was changed to $5 par value stock

*4. Declared a small stock dividend when the market value was higher than the par value

5. Declared a cash dividend

*6. Issued the shares of common stock required by the stock dividend declaration in 4. above

7. Issued par value common stock for cash at par value

8. Paid the cash dividend

Instructions

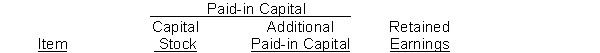

Indicate the effect(s) of each of the foregoing items on the subdivisions of stockholders' equity. Present your answers in tabular form with the following columns. Use (I) for increase, (D) for decrease, and (NE) for no effect.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: The Paid-in Capital in Excess of Par

Q29: Why must a corporation have sufficient retained

Q50: Stock dividends and stock splits have the

Q54: S. Lawyer performed legal services for E.

Q56: If a corporation pays taxes on its

Q58: Dawson Company issued 600 shares of no-par

Q59: In published annual reports,<br>A)subclassifications within the stockholders'

Q77: The two ways that a corporation can

Q196: Paid-in capital in excess of stated value

Q261: What is the formula for the payout