Multiple Choice

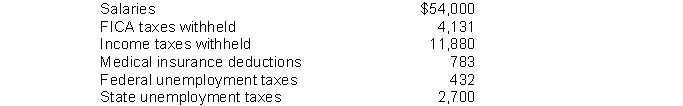

The following totals for the month of March were taken from the payroll records of Kern Company.  The entry to record the accrual of federal unemployment tax would include a

The entry to record the accrual of federal unemployment tax would include a

A) credit to Federal Unemployment Taxes Payable for $432.

B) debit to Federal Unemployment Taxes Expense for $432.

C) credit to Payroll Tax Expense for $432.

D) debit to Federal Unemployment Taxes Payable for $432.

Correct Answer:

Verified

Correct Answer:

Verified

Q35: A corporation issues $200,000, 8%, 5-year bonds

Q54: The effective interest method produces a constant

Q67: If the market interest rate for a

Q117: The carrying value of a bond is

Q154: A company receives $176, of which $16

Q155: On January 1, Thompson Corporation issued $3,000,000,

Q174: If bonds sell at a premium, the

Q259: A $750,000 bond was retired at 103

Q262: Yanik Corporation issues 4,000, 10-year, 8%, $1,000

Q276: Thayer Company purchased a building on January