Multiple Choice

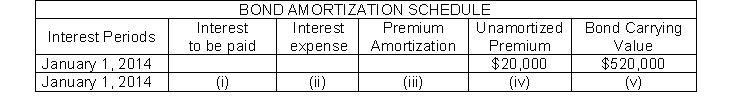

The following partial amortization schedule is available for Courtney Company who sold $500,000, five-year, 10% bonds on January 1, 2014 for $520,000 and uses annual straight-line amortization.  Which of the following amounts should be shown in cell (iii) ?

Which of the following amounts should be shown in cell (iii) ?

A) $10,000

B) $20,000

C) $4,000

D) $2,000

Correct Answer:

Verified

Correct Answer:

Verified

Q36: The following totals for the month of

Q46: Wynne Company issued $900,000 of 10%, 5-year

Q55: On January 1, 2014, Keisler Company, a

Q56: Sales taxes collected by a retailer are

Q131: Bonds are a form of interest-bearing notes

Q150: Neufeld Company issued $800,000 of 6%, 5-year

Q162: The times interest earned is computed by

Q240: Unearned revenues are received before goods are

Q242: Sales taxes collected by a retailer from

Q244: If the market rate of interest at