Essay

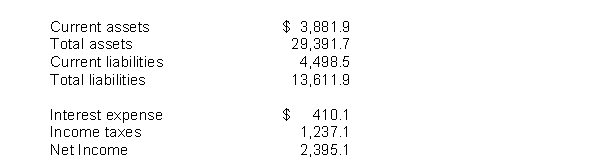

McDonald's financial statements contain the following selected data (in millions).  Instructions

Instructions

(a) Compute the following values and provide a brief interpretation of each.

(1) Working capital. (3) Debt to assets ratio.

(2) Current ratio. (4) Times interest earned.

(b) The notes to McDonald's financial statements show that subsequent to this year the company will have future minimum lease payments under operating leases of $10,513.8 million. If these assets had been purchased with debt, assets and liabilities would rise by approximately $9,400 million. Recompute the debt to assets ratio after adjusting for this. Discuss your result.

Correct Answer:

Verified

A current ratio that is less than 1.00 ...

A current ratio that is less than 1.00 ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: Sielert Corporation borrowed $900,000 from National Bank

Q23: A corporation issues $200,000, 10%, 5-year bonds

Q106: The board of directors may authorize more

Q137: Finney Company borrowed €1,600,000 from BankTwo on

Q172: Interest expense on an interest-bearing note is<br>A)

Q182: The market value (present value) of a

Q220: Gomez Corporation issues 600, 10-year, 8%, $1,000

Q221: Warner Company issued $4,000,000 of 6%, 10-year

Q257: Renfro Company issued $300,000 of 8%, 10-year

Q290: On January 1, Sewell Corporation issues $2,000,000,