Multiple Choice

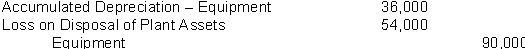

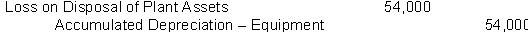

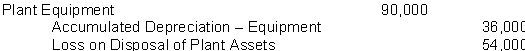

In 2014, Blanchard Corporation has plant equipment that originally cost $90,000 and has accumulated depreciation of $36,000. A new processing technique has rendered the equipment obsolete, so it is retired. Which of the following entries should Blanchard use to record the retirement of the equipment?

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q37: How is the cost for a plant

Q88: A characteristic of capital expenditures is that

Q126: Which of the following is not an

Q127: Equipment with a cost of $225,000 has

Q131: Intangible assets are the rights and privileges

Q132: On January 1, a machine with a

Q172: Salem Company hired Kirk Construction to construct

Q188: Pearson Company bought a machine on January

Q205: As a recent graduate of State University

Q254: (Communication)<br>The Old Fix-It is a company specializing