Essay

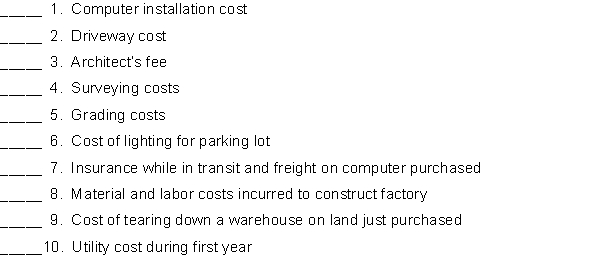

Indicate whether each of the following expenditures should be classified as land (L), land improvements (LI), buildings (B), equipment (E), or none of these (X).

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q22: Machinery was purchased for $170,000. Freight charges

Q59: On January 1, a machine with a

Q149: Additions and improvements<br>A)occur frequently during the ownership

Q190: The declining-balance method of depreciation produces a(n)<br>A)decreasing

Q197: Faster Company purchased equipment in 2007 for

Q198: A computer company has $3,000,000 in research

Q223: Presented below are selected transactions for the

Q237: Newell Company purchased a machine with a

Q257: A truck costing $45,000 and on which

Q304: Land improvements should be depreciated over the