Essay

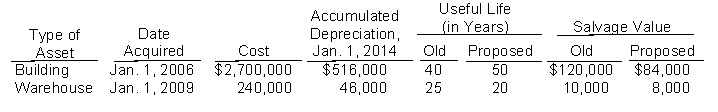

Mike Geary, the controller of Shellhammer Company, has reviewed the expected useful lives and salvage values of selected depreciable assets at the beginning of 2014. Here are his findings:  All assets are depreciated by the straight-line method. Shellhammer Company uses a calendar year in preparing annual financial statements. After discussion, management has agreed to accept Mike's proposed changes. (The "Proposed" useful life is total life, not remaining life.)

All assets are depreciated by the straight-line method. Shellhammer Company uses a calendar year in preparing annual financial statements. After discussion, management has agreed to accept Mike's proposed changes. (The "Proposed" useful life is total life, not remaining life.)

Instructions

(a) Compute the revised annual depreciation on each asset in 2014. (Show computations.)

(b) Prepare the entry (or entries) to record depreciation on the building in 2014.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: A machine was purchased for $54,000 and

Q31: Equipment that cost $54,000 and on which

Q47: Equipment was acquired on January 1, 2010,

Q80: You are comparing two companies in the

Q94: In computing depreciation salvage value is<br>A) the

Q118: * 205. A company purchased factory equipment

Q139: The book value of an asset will

Q147: On July 1, 2014, Linden Company purchased

Q209: All of the following statements about the

Q218: When estimating the useful life of an