Multiple Choice

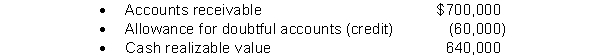

The following information is related to December 31, 2013 balances.  During 2014 sales on account were $195,000 and collections on account were $115,000. Also, during 2014 the company wrote off $11,000 in uncollectible accounts. An analysis of outstanding receivable accounts at year end indicated that bad debts should be estimated at $72,000. The change in the cash realizable value from the balance at 12/31/13 to 12/31/14 was

During 2014 sales on account were $195,000 and collections on account were $115,000. Also, during 2014 the company wrote off $11,000 in uncollectible accounts. An analysis of outstanding receivable accounts at year end indicated that bad debts should be estimated at $72,000. The change in the cash realizable value from the balance at 12/31/13 to 12/31/14 was

A) $68,000 increase.

B) $80,000 increase.

C) $57,000 increase.

D) $69,000 increase.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: The following data exists for Mather Company.

Q8: Which permits partial derecognition of receivables? <img

Q26: When an account becomes uncollectible and must

Q58: Trade receivables can be an account receivable

Q63: The percentage of receivables approach to estimating

Q67: Under the allowance method, Bad Debt Expense

Q81: Finney had the following transactions during March

Q109: An aging schedule is prepared only for

Q206: Using the allowance method, the uncollectible accounts

Q206: The direct write-off method of accounting for