Multiple Choice

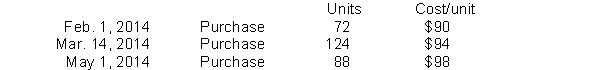

Dole Industries had the following inventory transactions occur during 2014:  The company sold 204 units at $126 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, and operating expenses of $2,000, what is the company's after-tax income using LIFO? (rounded to whole dollars)

The company sold 204 units at $126 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, and operating expenses of $2,000, what is the company's after-tax income using LIFO? (rounded to whole dollars)

A) $4,176

B) $4,323

C) $3,349

D) $2,923

Correct Answer:

Verified

Correct Answer:

Verified

Q6: When the terms of sale are FOB

Q83: Goods held on consignment are<br>A)never owned by

Q95: If companies have identical inventoriable costs but

Q135: The LIFO method is rarely used because

Q141: The requirements for accounting for and reporting

Q188: Hoover Company had beginning inventory of $15,000

Q223: Hogan Industries had the following inventory transactions

Q225: Charlene Cosmetics Company just began business and

Q226: Classic Floors has the following inventory data:

Q230: Ace Company is a retailer operating in