Short Answer

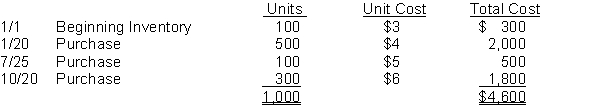

Hansen Company uses the periodic inventory method and had the following inventory information available:  A physical count of inventory on December 31 revealed that there were 380 units on hand.

A physical count of inventory on December 31 revealed that there were 380 units on hand.

Instructions

Answer the following independent questions and show computations supporting your answers.

1. Assume that the company uses the FIFO method. The value of the ending inventory at December 31 is $__________.

2. Assume that the company uses the average cost method. The value of the ending inventory on December 31 is $__________.

3. Assume that the company uses the LIFO method. The value of the ending inventory on December 31 is $__________.

4. Determine the difference in the amount of income that the company would have reported if it had used the FIFO method instead of the LIFO method. Would income have been greater or less?

Correct Answer:

Verified

Income would have b...

Income would have b...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q28: The specific identification method of inventory valuation

Q81: Use of the LIFO inventory valuation method

Q94: Carter Company reported these income statement data

Q95: Bonkers Bananas has the following inventory data:

Q97: Hogan Industries had the following inventory transactions

Q117: Dennis Lee, an auditor with Knapp CPAs,

Q122: Independent internal verification of the physical inventory

Q137: If goods in transit are shipped FOB

Q182: The LIFO inventory method assumes that the

Q184: The specific identification method of costing inventories