Essay

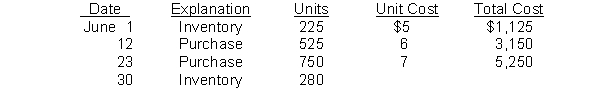

Johnson Company reports the following for the month of June.  (a) Compute the cost of the ending inventory and the cost of goods sold under (1) FIFO, (2) LIFO, and (3) average cost.

(a) Compute the cost of the ending inventory and the cost of goods sold under (1) FIFO, (2) LIFO, and (3) average cost.

(b) Which costing method gives the highest ending inventory? The highest cost of goods sold? Why?

(c) How do the average-cost values for ending inventory and cost of goods sold relate to ending inventory and cost of goods sold for FIFO and LIFO?

Correct Answer:

Verified

(b) The FIFO method will produce the hi...

(b) The FIFO method will produce the hi...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: The term "FOB" denotes<br>A) free on board.<br>B)

Q61: Condensed income statements for Werly Corporation are

Q66: Which inventory method generally results in costs

Q66: An error in the ending inventory of

Q68: Plato Company reports the following for the

Q69: The option to value inventory at fair

Q101: Selection of an inventory costing method by

Q122: For companies that use a perpetual inventory

Q127: Many companies use just-in-time inventory methods.Which of

Q175: The accounting principle that requires that the