Essay

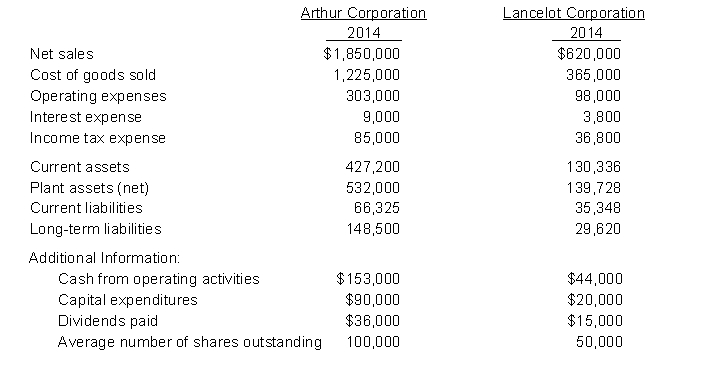

Comparative financial statement data for Arthur Corporation and Lancelot Corporation, two competitors, appear below. All balance sheet data are as of December 31, 2014.  Instructions

Instructions

(a) Comment on the relative profitability of the companies by computing the net income and earnings per share for each company for 2014.

(b) Comment on the relative solvency of the companies by computing the debt to assets ratio and the free cash flow for each company for 2014.

Correct Answer:

Verified

(a) Arthur Company appears to be more pr...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: Long-term creditors consider a high free cash

Q13: Which of the following organizations issues accounting

Q34: The debt to assets ratio is computed

Q65: A useful measure of solvency is the<br>A)current

Q93: The current ratio is<br>A)current assets plus current

Q120: Working capital is<br>A)calculated by dividing current assets

Q149: The retained earnings statement is more comprehensive

Q160: Use the following data to determine the

Q188: For accounting information to have relevance, it

Q235: What organization issues U.S. accounting standards?<br>A) Security