Multiple Choice

On January 1, Vega Company purchased as an investment a $1,000, 8% bond for $1,000. The bond pays interest on January 1 and July 1. The bond is sold on October 1 for $1,080 plus accrued interest. Interest has not been accrued since the last interest payment date. What is the entry to record the cash proceeds at the time the bond is sold?

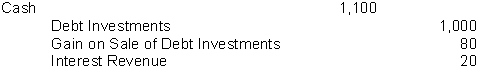

A)

B)

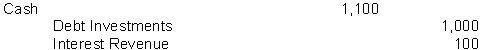

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q32: Unrealized gains and losses on available-for-sale securities

Q50: Mazzeo Company acquires 80 Dodd's 10%, 5

Q64: Which of the following is not necessary

Q93: La Bouisse Inc. obtained significant influence over

Q127: If $10,000 is put in a savings

Q139: The cost method of accounting for investments

Q148: When a company owns more than 50%

Q169: A stock investment classified as trading securities

Q171: If the single amount of $12,500 is

Q286: Cedar Co. purchased 120, 6% LKN Company