Multiple Choice

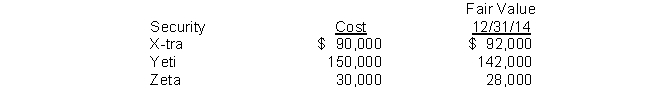

At December 31, 2014, the trading securities for Blue Bell, Inc. are as follow  Blue Bell should report the following amount related to the securities transactions in its 2014 income statement

Blue Bell should report the following amount related to the securities transactions in its 2014 income statement

A) $2,000 gain.

B) $8,000 realized loss.

C) $8,000 unrealized loss.

D) $10,000 unrealized loss.

Correct Answer:

Verified

Correct Answer:

Verified

Q42: When the cost method is used to

Q71: The cost method of accounting for investments

Q128: BB Company issued 11%, 5-year, $600,000 face

Q129: Parks Blair invested $5,000 at 8% annual

Q130: alentyne Company borrowed $95,000 on January 2,

Q133: Deutsche Corporation's trading portfolio at the end

Q136: If the cost of an available-for-sale security

Q172: When a company owns more than 50%

Q204: Which of the following is not a

Q273: Present value is based on<br>A) the dollar