Multiple Choice

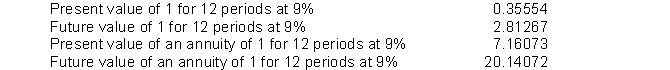

Montz Company is considering investing in an annuity contract that will return $80,000 annually at the end of each year for 12 years. Montz has obtained the following values related to the time value of money to help in its planning process and compounded interest decisions.  To the closest dollar, what amount should Montz Company pay for this investment if it earns a 9% return?

To the closest dollar, what amount should Montz Company pay for this investment if it earns a 9% return?

A) $994,132

B) $1,185,014

C) $1,611,258

D) $572,858

Correct Answer:

Verified

Correct Answer:

Verified

Q40: The future value of 1 factor will

Q52: At January 1, 2014, the available-for-sale securities

Q107: FTX Company owns 10% interest in the

Q127: All of the following statements about short-term

Q145: Dividends received on stock investments of less

Q147: The Fair Value Adjustment account<br>A) is set

Q165: The Fair Value Adjustment account is a

Q177: On January 1, 2014, JBT Company purchased

Q181: Parks Blair invested $5,000 at 8% annual

Q201: All of the following factors would be