Multiple Choice

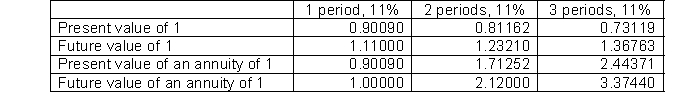

Wiggins Company is considering purchasing equipment. The equipment will produce the following cash flows: Year 1, $50,000; Year 2, $90,000; Year 3, $130,000. Below is some of the time value of money information that Wiggins has compiled that might help them in their planning and compounded interest decisions.  Wiggins requires a minimum rate of return of 11%. To the closest dollar, what is the maximum price Wiggins should pay for the equipment?

Wiggins requires a minimum rate of return of 11%. To the closest dollar, what is the maximum price Wiggins should pay for the equipment?

A) $219,137

B) $213,146

C) $218,099

D) $208,499

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Glover Company is about to issue $3,000,000

Q67: enny Corsig purchased an investment for $9,818.15.

Q68: Porter Company has just purchased equipment that

Q76: On January 1, 2014, Tri-State Supply Company

Q87: If a stock investment is sold at

Q166: When the cost method is used to

Q173: Dividends received on investments are accounted for

Q179: A consolidated balance sheet reports the financial

Q193: Eaton Company had the following transactions pertaining

Q270: Hardin Park Company had these transactions pertaining