Multiple Choice

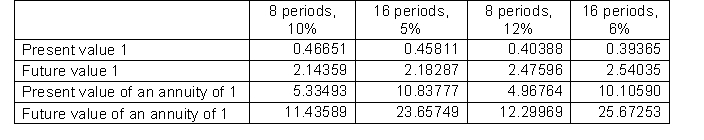

Chenard Company is about to issue $3,000,000 of 8-year bonds paying a 12% interest rate with interest payable semiannually. The discount rate for such securities is 10%. Below are time value of money factors that Chenard uses to calculate compounded interest.  To the closest dollar, how much can Chenard expect to receive for the sale of these bonds?

To the closest dollar, how much can Chenard expect to receive for the sale of these bonds?

A) $3,193,390

B) $2,293,710

C) $3,325,130

D) $5,400,000

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Under the equity method the Stock Investments

Q79: When investing excess cash for short periods

Q100: McComb Inc. earns $900,000 and pays cash

Q105: Crosby Corporation sells 300 shares of common

Q158: In accounting for stock investments of less

Q170: When investments in bonds are sold, any

Q204: Pension funds and mutual funds are corporations

Q205: Vangaurd Co. purchased 50, 6% McLaughlin Company

Q262: Under the cost method of accounting for

Q277: The amount you must deposit now in