Multiple Choice

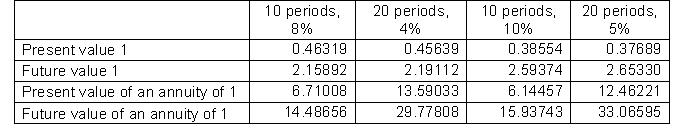

Patterson Company is about to issue $8,000,000 of 10-year bonds paying an 8% interest rate with interest payable semiannually. The discount rate for such securities is 10%. Below are time value of money factors that Patterson uses to calculate compounded interest.  To the closest dollar, how much can Patterson expect to receive for the sale of these bonds?

To the closest dollar, how much can Patterson expect to receive for the sale of these bonds?

A) $7,003,027

B) $5,852,740

C) $16,000,000

D) $28,110,060

Correct Answer:

Verified

Correct Answer:

Verified

Q10: If the equity method is being used,

Q13: Under the equity method the investor records

Q46: If an investor owns less than 20%

Q91: The receipt of dividends on an investment

Q141: oub Company issued $4,000,000, 10-year bonds and

Q144: The present value of a bond is

Q146: wen and Steve Jones Jeter invested $10,000

Q249: Mergenthaler Company has just purchased machinery that

Q256: (a)What is the present value of $32,000

Q267: If a bond has a contract rate