Essay

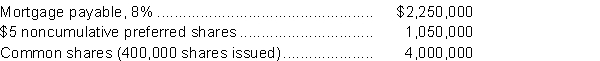

The statement of financial position for Hyde Corporation at the end of the current year includes the following:  Income before income tax was $1,850,000, and income tax expense for the current year was $550,000. Cash dividends paid on common shares was $200,000, and cash dividends paid on preferred shares was $100,000. The common shares were selling for $85 per share at year end.

Income before income tax was $1,850,000, and income tax expense for the current year was $550,000. Cash dividends paid on common shares was $200,000, and cash dividends paid on preferred shares was $100,000. The common shares were selling for $85 per share at year end.

Instructions

Calculate the following ratios:

a) Earnings per share

b) Price/earnings

c) Dividend yield

Correct Answer:

Verified

a) Earnings per share: ($1,300,000 - $10...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q38: Which of the following descriptions best describes

Q44: Historical results cannot be used as a

Q47: Which of the following depicts earnings per

Q50: The descriptive sections of the annual report

Q57: Which of the following is <b>not</b> an

Q79: The diversity of operations can make it

Q85: Which of the following companies would be

Q86: Why is it important for an analyst

Q87: The analysis of financial statements to assist

Q90: Identify the different users of the financial