Multiple Choice

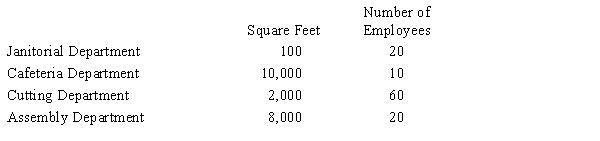

Using the direct method, Pone Hill Company allocates Janitorial Department costs based on square footage serviced. It allocates Cafeteria Department costs based on the number of employees served. It has the following information about its two service departments and two production departments, Cutting and Assembly:  If the Cafeteria Department incurs costs of $500,000, how much of that cost is allocated to the Assembly Department?

If the Cafeteria Department incurs costs of $500,000, how much of that cost is allocated to the Assembly Department?

A) $375,000

B) $111,000

C) $125,000

D) $91,000

Correct Answer:

Verified

Correct Answer:

Verified

Q24: In which of the following scenarios would

Q25: One of the reasons that James Company

Q26: Match each description below to the appropriate

Q27: An example of the split-off point in

Q28: Using the performance report for Scotland Beauty

Q30: Which of the following methods allocates joint

Q31: Joint costs are inseparable after the split-off

Q32: Jamison Company uses the reciprocal services method

Q33: Scotland Beauty Products manufactures face cream, body

Q34: Which of the following explains why it