Essay

Tulip Company produces two products, T and U. The indirect labor costs include the following two items:  The following activity-base usage and unit production information is available for the two products:

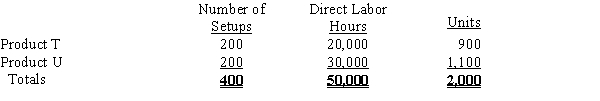

The following activity-base usage and unit production information is available for the two products:

a.Determine the single plantwide factory overhead rate, using direct labor hours as the activity base.

b.Determine the factory overhead allocated per unit for Products T and U, using the single plantwide factory overhead rate.

c.Determine the activity rate for plant supervision and setup labor, assuming that the activity base for supervision is direct labor hours and the activity base for setup labor is number of setups.

d.Determine the factory overhead allocated per unit for Products T and U, using the activity-based costing method.

e.Why is the factory overhead allocated per unit different for the two products under the two methods?

Correct Answer:

Verified

a.Single plantwide factory overhead rate...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q75: Roget Factory has budgeted factory overhead for

Q76: Activity-based costing can be used to allocate

Q77: Multiple production department factory overhead rates are

Q78: Explain why it is imperative that proper

Q79: When production departments differ significantly in their

Q81: Ramapo Company produces two products, Blinks and

Q82: Kaumajet Factory produces two products: table lamps

Q83: Activity cost pools are factory overhead costs

Q84: Dawson Company manufactures small table lamps and

Q85: Panamint Systems Corporation is estimating activity costs