Multiple Choice

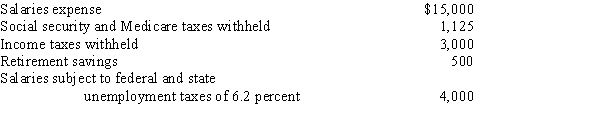

The following totals for the month of June were taken from the payroll register of Young Company:  The entry to record the accrual of employer's payroll taxes would include a debit to

The entry to record the accrual of employer's payroll taxes would include a debit to

A) Payroll Tax Expense for $2,498

B) Social Security and Medicare Tax Payable for $2,250

C) Payroll Tax Expense for $1,373

D) Payroll Tax Expense for $3,000

Correct Answer:

Verified

Correct Answer:

Verified

Q54: The journal entry a company uses to

Q55: Below are two independent sets of transactions

Q55: A current liability is a debt that

Q58: Which of the following would be used

Q74: The journal entry a company uses to

Q84: Match each of the following items with

Q125: The payroll register of Seaside Architecture Company

Q139: Several months ago, Maximilien Company experienced a

Q140: A business issued a 120-day, 6% note

Q187: Federal income taxes withheld increase the employer's