Multiple Choice

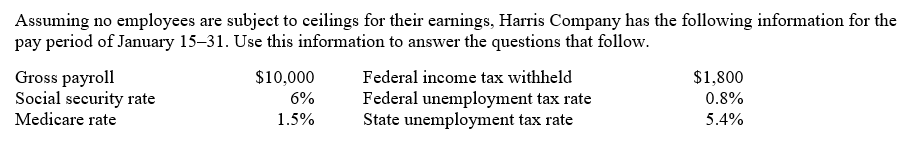

-Assume that social security taxes are payable at a 6% rate and Medicare taxes are payable at a 1.5% rate with no maximum earnings, and that federal and state unemployment compensation taxes total 6.2% on the first $7,000 of earnings. If an employee earns $2,500 for the current week and the employee's year-to-date earnings before this week were $6,800, what is the total employer payroll taxes related to the current week?

A) $187.50

B) $199.90

C) $342.50

D) $12.40

Correct Answer:

Verified

Correct Answer:

Verified

Q48: Obligations that may arise from past transactions

Q109: Sterling Inc. has two long-term notes outstanding.

Q110: Several months ago, Jones Company experienced

Q111: On January 5, Thomas Company, a calendar-year

Q112: Hall Company sells merchandise with a one-year

Q113: Hadley Industries warrants its products for one

Q115: Which of the following would most likely

Q116: Martin Jackson receives an hourly wage rate

Q185: Form W-4 is a form authorizing employers

Q196: Payroll taxes only include social security taxes