Essay

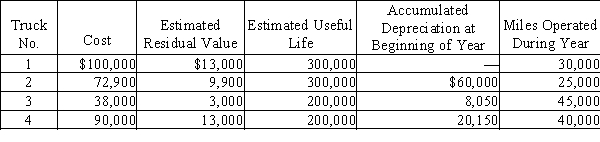

Prior to adjustment at the end of the year, the balance in Trucks is $300,900 and the balance in Accumulated Depreciation-Trucks is $88,200. Details of the subsidiary ledger are as follows:  Required:

Required:

(a)Based on the units-of-output method, determine the depreciation rates per mile and the amount to be credited to the accumulated depreciation section of each of the subsidiary accounts for the miles operated during the current year.(b)Journalize the entry to record depreciation for the year.

Correct Answer:

Verified

(a)  (b)Depreciation...

(b)Depreciation...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: The normal balance of the accumulated depreciation

Q20: A lathe priced at a fair market

Q67: When exchanging equipment, if the trade-in allowance

Q88: The higher the fixed asset turnover, the<br>A)

Q103: Expenditures for research and development are generally

Q114: Classify each of the following costs associated

Q123: A gain can be realized when a

Q172: Standby equipment held for use in the

Q202: When a property, plant, and equipment asset

Q215: Functional depreciation occurs when a fixed asset