Essay

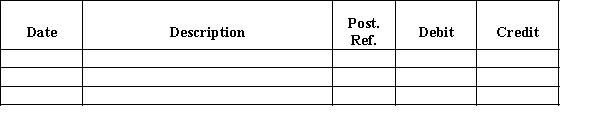

Carter Co. acquired drilling rights for $18,550,000. The oil deposit is estimated at 74,200,000 gallons. During the current year, 6,000,000 gallons were drilled. Journalize the adjusting entry at December 31 to recognize the depletion expense.Journal

Correct Answer:

Verified

*Depletion rate = Cost/Estimated size

*Depletion rate = Cost/Estimated size

D...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

D...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Land acquired as a speculation is reported

Q53: On April 15, Compton Co. paid $2,800

Q79: When selling a piece of equipment for

Q112: On December 31, Strike Company sold one

Q118: The accumulated depletion of a natural resource

Q121: The process of transferring the cost of

Q136: Solare Company acquired mineral rights for $60,000,000.

Q165: The amount of depreciation expense for the

Q181: The name, term, or symbol used to

Q223: When a company exchanges machinery and receives