Multiple Choice

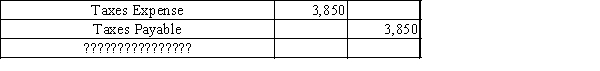

The following adjusting journal entry found in the journal is missing an explanation. Select the best explanation for the entry.

A) Record payment of taxes.

B) Record taxes expense incurred and to be paid in next period.

C) Record taxes paid in advance.

D) Record tax bill received from government.

Correct Answer:

Verified

Correct Answer:

Verified

Q14: DogMart Company records depreciation for equipment. Depreciation

Q73: Generally accepted accounting principles require that companies

Q112: Match the type of account (a through

Q135: Smokey Company purchases a one-year insurance policy

Q154: Explain the difference between accrual basis accounting

Q185: The following adjusting journal entry does not

Q187: If the effect of the debit portion

Q192: Depreciation on an office building is $2,800.

Q194: For each of the following, journalize the

Q202: If the effect of the credit portion