Essay

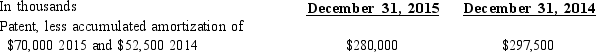

Several years ago, Laurel Company purchased a patent and has since been amortizing it on a straight-line basis over its estimated useful life. The company's comparative balance sheets contain the following items:

A. How much amortization expense was recorded during 2015?

A. How much amortization expense was recorded during 2015?

B. How is the amortization expense reported on the company's statement of cash flows?

C. How much was the original cost of the patent?

D. How many years has the patent been amortized?

Correct Answer:

Verified

A. $70,000 - $52,500 = $17,500

B. If the...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

B. If the...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q55: Lenders are interested in the value of

Q70: Flexibility in valuation of property,plant,and equipment under

Q99: Garner,Inc.determined that it had incorrectly estimated both

Q105: Why is depreciation added to net income

Q120: Select the account that would be increased

Q133: All of the following statements are true

Q139: With respect to operating assets, the two

Q151: Land is not depreciated because it<br>A) appreciates

Q157: The Loss on Sale of Asset indicates

Q238: Sara's Designs purchased equipment at the beginning