Essay

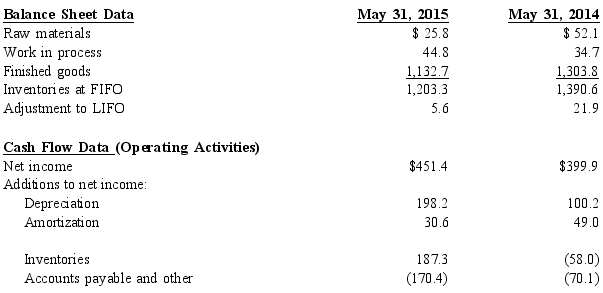

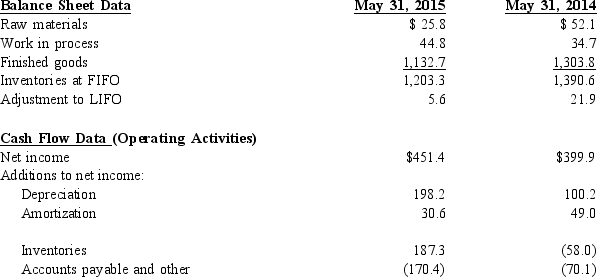

In the following information from the 2015 annual reports of Focal Point Industries all figures have been rounded to millions of dollars.

Changes in assets and liabilities:

REQUIRED:

1 Explain what the amount "adjustment to LIFO" represents. What effects has this "adjustment" had on Focal

1 Explain what the amount "adjustment to LIFO" represents. What effects has this "adjustment" had on Focal

Point Industries' net earnings in 2014 and 2015?

2 What method of determining cash flows from operating activities has Focal Point Industries used in preparing its statement of cash flows? Explain your answer.

3 From 2014 to 2015, what change in the inventory balance increase or decrease occurred in each year as a result of operating activities? What was the effect on the company's cash flow each year as a result of the inventory change?

Correct Answer:

Verified

1 The "adjustment to LIFO" of inventorie...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: Transportation-in is<br>A) an operating expense<br>B) a stockholders'

Q9: Giant-Mart purchased a large shipment of shoes

Q10: Cost of goods sold is equal to

Q16: Park, Inc.purchased merchandise from Jay Zee Music

Q33: The journal entry to write down inventory

Q36: Under the indirect method, a decrease in

Q40: The excess of the value of a

Q80: For which type of inventory would a

Q99: Summer, Inc.has been in business for 20

Q130: Match the inventory-related accounts to costs that