Short Answer

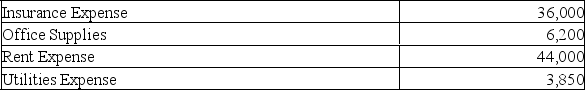

The partial unadjusted trial balance of Erif Corporation at December 31, 2020 follows. All accounts have normal balances.

The following additional information is available at the December 31, 2020 year end: a. Insurance expense represents a 3-year insurance policy for the period from January 1, 2020 to December 31, 2022. b. A count of office supplies reveals that at December 31, 2020, the company had $500 of office supplies on hand. c. The company's lease, signed on January 1, 2020, specifies monthly rent of $4,000, or $48,000 a year. d. The December 2020 utility bill has not yet been received and is not included in the trial balance. The utility bill averages $400 a month. Required - Using the information above, find the balances in the following account balances, after adjustment, at December 31, 2020:

The following additional information is available at the December 31, 2020 year end: a. Insurance expense represents a 3-year insurance policy for the period from January 1, 2020 to December 31, 2022. b. A count of office supplies reveals that at December 31, 2020, the company had $500 of office supplies on hand. c. The company's lease, signed on January 1, 2020, specifies monthly rent of $4,000, or $48,000 a year. d. The December 2020 utility bill has not yet been received and is not included in the trial balance. The utility bill averages $400 a month. Required - Using the information above, find the balances in the following account balances, after adjustment, at December 31, 2020:

-Utilities Expense

Correct Answer:

Verified

Correct Answer:

Verified

Q126: In accrual basis accounting, accrued revenues are

Q127: The accounting basis that attempts to measure

Q128: Throughout an accounting period, the fees for

Q129: At year-end, the accountant for<br>D. Yee

Q130: Accrued expenses at the end of one

Q132: The Surrey Service Company issued financial statements

Q133: For the current year, the profit of

Q134: A balance sheet that places the assets

Q135: The entry to record a cash receipt

Q136: To correct the error in debiting a