Essay

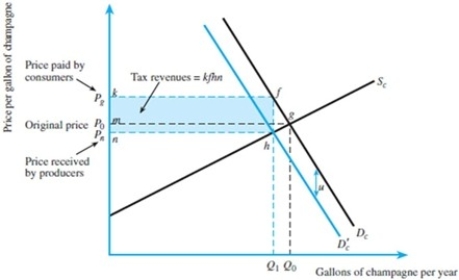

Refer to the figure below. Suppose the original before-tax demand curve for champagne is P = 100 - 2Qd. Suppose further that supply is P = 5 + 3Qs. Now suppose a $5 unit tax is imposed on consumers.

(A)What is the before-tax equilibrium price and quantity?

(A)What is the before-tax equilibrium price and quantity?

(B)What is the after-tax equilibrium price and quantity?

(C)How much tax revenue is raised?

Correct Answer:

Verified

(A)Setting before-tax demand equal to su...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q14: Marginal tax rates supply reliable measures of

Q20: General equilibrium analysis<br>A)finds equilibrium from general information.<br>B)examines

Q22: The economic incidence of a tax is<br>A)generally

Q23: A tax on suppliers will cause<br>A)a movement

Q27: Taxes<br>A)are the only way of financing government

Q28: Ad valorem taxes create tax wedges just

Q28: The ease with which capital can be

Q29: A lump sum tax is one for

Q31: Why is it the case that a

Q34: Why is it the case that taxes