Multiple Choice

The following information is needed to reconcile the cash balance for Woods Paper Products. • A deposit of $5 794.62 is in transit.

• Outstanding cheques total $1 533.25.

• The book balance is $5 695.62.

• The bookkeeper recorded a $1 524.00 cheque as $15 240 in payment of the current month's rent.

• The bank balance at 28 February 2014 was $16 500.25.

• A deposit of $300 was credited by the bank for $3 000.

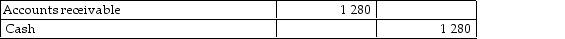

• A customer's cheque for $1 280 was returned for nonsufficient funds.

• The bank service charge is $70.

Which of the following journal entries is needed to adjust for the dishonoured cheque?

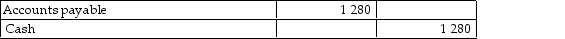

A)

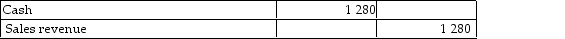

B)

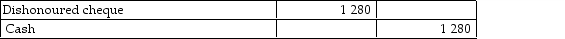

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q4: A basic principle of internal control over

Q41: Petty cash is a fund containing a

Q91: Which of the following describes collusion?<br>A)When bogus

Q93: Which of the following items are both

Q94: Which of the following is a benefit

Q95: Which of the following statements describes a

Q97: Please refer to the following bank reconciliation:

Q98: A petty cash fund was established with

Q99: In the following situation, which internal control

Q101: Petty cash is accounted for by maintaining