Essay

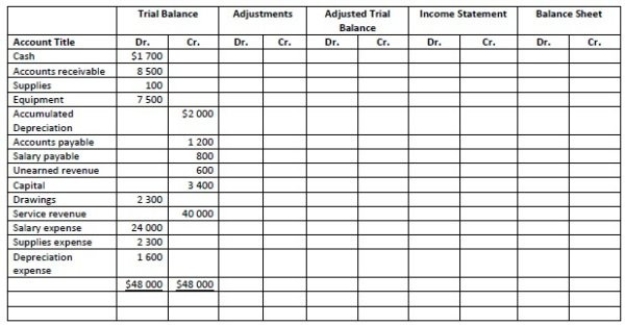

Please refer to the worksheet below:

Post adjustments needed according to the information below, and complete the worksheet.

Post adjustments needed according to the information below, and complete the worksheet.

· At year- end, the company has earned $2 000 of service revenue from a client, but has not yet completed the job, or received a payment.

· At year- end, the company owes $180 of salaries to its staff that it has not paid yet.

· At year- end, the company has only $20 of supplies left.

· At year- end, the company records $240 of depreciation expense.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Under which of the following categories would

Q2: Revenues total $10 200. Expenses total $7

Q3: Please refer to the following partially completed

Q4: Which of the following accounts does NOT

Q5: What is the result if the amount

Q7: Where does Profit appear on a worksheet?<br>A)Profit

Q8: Which of the following would be considered

Q53: Cash is a temporary account.

Q102: Accounts receivable is a permanent account.

Q154: Accumulated depreciation is a permanent account.