Multiple Choice

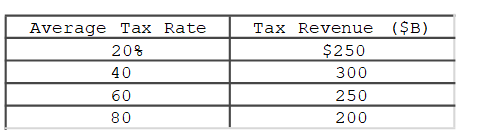

Refer to the table.If the current tax rate is 60 percent, supply-side economists would advocate

A) lowering tax rates to 20 percent, or lower if possible.

B) lowering tax rates to 40 percent.

C) keeping tax rates at 60 percent.

D) raising tax rates to 80 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q84: If the government adopts a hands-off policy

Q85: The Phillips Curve shows a positive relationship

Q86: Suppose that the Consumer Price Index for

Q87: A rightward and upward shift of the

Q88: A stable Phillips curve does not allow

Q90: The automatic adjustment mechanism that makes the

Q92: Based on the long-run Phillips Curve, any

Q93: Statistical data for the 1970s and 1980s

Q94: The traditional Phillips Curve showing a trade-off

Q100: The short-run aggregate supply curve is vertical,