Multiple Choice

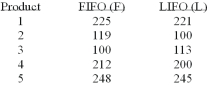

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000) for five products both ways. Based on the following results, is LIFO more effective in keeping the value of his inventory lower?  What is the value of calculated t?

What is the value of calculated t?

A) +0.93

B) ±2.776

C) +0.0.47

D) -2.028

E) None of these statements are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q51: i. A committee studying employer-employee relations proposed

Q77: The employees at the East Vancouver office

Q78: The employees at the East Vancouver office

Q78: Married women are more often than not

Q79: Married women are more often than not

Q80: What is the critical value for a

Q81: If the decision is to reject the

Q82: The employees at the East Vancouver office

Q86: To compare the effect of weather on

Q87: To compare the effect of weather on