Multiple Choice

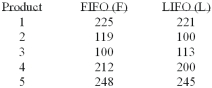

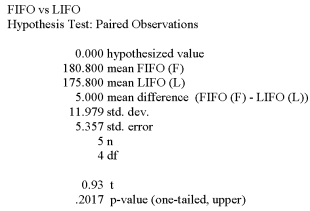

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000) for five products both ways. Based on the following results, is LIFO more effective in keeping the value of his inventory lower?  What is the decision at the 5% level of significance?

What is the decision at the 5% level of significance?

A) Looking at the large P-value of .2019 we conclude LIFO is more effective.

B) Reject the null hypothesis and conclude LIFO is more effective.

C) Reject the alternate hypothesis and conclude LIFO is more effective. DThe large P-value of .2017 indicates that there is a good chance of getting this sample data when the

D) two methods are in fact not significantly different, so we conclude that LIFO is not more effective.

E) None of these statements are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q40: The employees at the East Vancouver office

Q41: i. The paired difference test has (n1

Q42: Of 250 adults who tried a new

Q43: i. If the null hypothesis states that

Q44: The results of a mathematics placement exam

Q46: A local retail business wishes to determine

Q47: A local retail business wishes to determine

Q49: i. If the null hypothesis states that

Q50: How is a pooled estimate represented?<br>A) pc<br>B)

Q97: Married women are more often than not