Short Answer

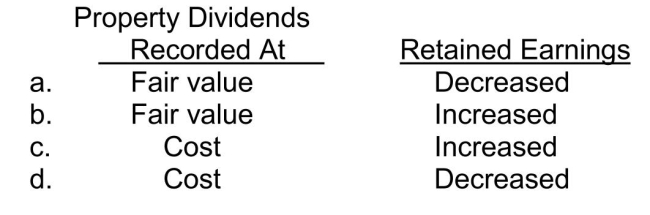

Emily Corp.owned shares in Carr Ltd.On December 1, 2014, Emily declared and distributed a property dividend of Carr shares when their fair value exceeded the carrying amount.As a consequence of the dividend declaration and distribution, the accounting effects Shareholders' Equity 15- 37 would be

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Cash dividends are paid on the basis

Q13: Which of the following may NOT be

Q30: Accounting for GST includes<br>A)crediting GST Payable to

Q31: Payroll entries The total payroll of Lyndon

Q32: On January 1, 2014, Varden Ltd.issued $4,000,000,

Q35: When valuing financial instruments at fair value

Q37: Browning Company's salaried employees are paid biweekly.Information

Q43: The numerator of the acid-test ratio consists

Q46: The debt to total assets earned ratio

Q89: Note disclosures for long-term debt generally include