Essay

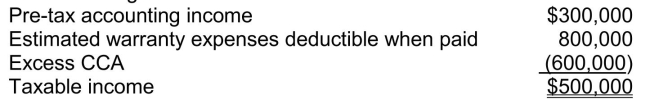

Future income taxes Nevada Corp., at the end of 2014, its first year of operations, prepared a reconciliation between pre-tax accounting income and taxable income as follows:  Estimated warranty expenses of $530,000 will be deductible in 2015, $200,000 in 2016, and $70,000 in 2017.The use of the depreciable assets will result in taxable amounts of $200,000 in each of the next three years. The enacted tax rate is 30% and is not expected to change. Instructions

Estimated warranty expenses of $530,000 will be deductible in 2015, $200,000 in 2016, and $70,000 in 2017.The use of the depreciable assets will result in taxable amounts of $200,000 in each of the next three years. The enacted tax rate is 30% and is not expected to change. Instructions

a.Prepare a schedule of the future taxable and deductible amounts.

b.Prepare the required adjusting journal entries to record income taxes for 2014.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: A feature common to both stock splits

Q19: On December 31, 2014, Street Ltd.has $2,000,000

Q20: Use the following information for questions. Riga

Q21: Rome Corp.was organized on January 1, 2014,

Q23: Asbestos Corp.is being sued for illness caused

Q24: On July 1, 2014, Tilapia Corp.had outstanding

Q26: Use the following information for questions. The

Q27: How would the declaration of a 15%

Q84: Which type of dividends do NOT reduce

Q114: When the interest payment dates of a