Multiple Choice

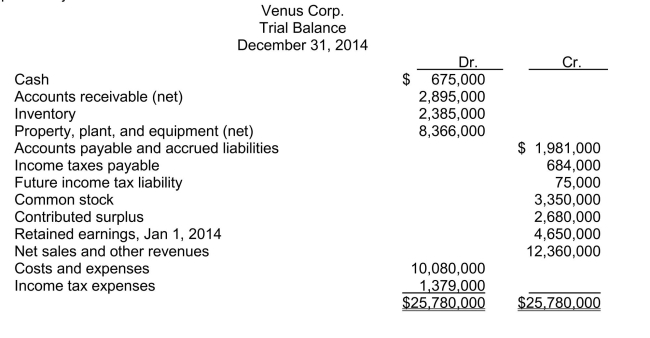

Use the following information for questions Venus Corp.'s trial balance at December 31, 2014 is properly adjusted except for the income tax expense adjustment.  Other financial data for the year ended December 31, 2014: - Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2016. - The balance in the future income tax liability account relates to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability. - During the year, estimated tax payments of $465,000 were charged to income tax expense. The current and future tax rate on all types of income is 35 percent.

Other financial data for the year ended December 31, 2014: - Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2016. - The balance in the future income tax liability account relates to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability. - During the year, estimated tax payments of $465,000 were charged to income tax expense. The current and future tax rate on all types of income is 35 percent.

-In Venus's December 31, 2014 statement of financial position, the current liabilities total is

A) $2,435,000.

B) $2,695,000.

C) $2,200,000.

D) $2,114,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q60: Which of the following is a current

Q202: Which of the following statements with respect

Q203: Use the following information for questions. Tuba

Q204: Amortization of discount under the straight-line and

Q205: Wilma received merchandise on consignment from Bubbles.As

Q206: Calculation of net income from the change

Q208: Factoring accounts receivable On April 1, Morocco

Q210: For calendar 2014, the gross profit of

Q211: Use the following information for questions The

Q212: Use the following information for questions. Tuba