Essay

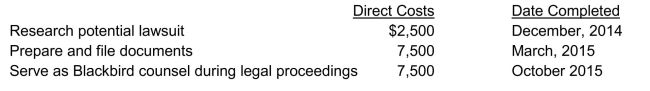

Revenue recognition In October 2014, Blackbird Inc.signed a contract for $30,000 with the BH Law office to provide legal services for Blackbird Inc.for the remainder of 2014 and all of 2015.Assume that BH can reliably estimate future direct costs associated with the contract.The following services were performed based on the estimate by BH:  Instructions Under the earnings approach,

Instructions Under the earnings approach,

a)When should BH recognize revenue in this situation? Explain.

b)Prepare journal entries to recognize revenues related to this contract on BH's books.

Correct Answer:

Verified

a)BH could use a method of proportional ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: The single-step income statement emphasizes<br>A) the gross

Q13: Dividends and interest receivable would be classified

Q26: The financial statement which summarizes operating, investing,

Q99: "Allowance for Doubtful Accounts" is a(n)<br>A) expense

Q110: Which of the following criteria does NOT

Q111: Capitalization of borrowing costs During 2014, Tibet

Q112: Which of the following statements is INCORRECT

Q115: Which of the following is NOT one

Q117: Which of the following statements regarding borrowing

Q118: Percentage-of-completion method Finch Construction Corp.contracted to build